How the code works:

This is what I have done so far. It contains the basic codes for BS Merton, CRR European and American Options. It also includes the greeks, delta, gamma and theta. I coded it the way I understood options. In a visual way. Though it's not yet tested for other numbers.

Sub Test() just contains the input and output of what is happening on the code since I'm just halfway done. The "user" part and the "output" part isn't completed yet. It is just presentable.

GenEurAm() contains the code in solving the option value and generating the values involved in the tree for Amerucan and European options.

Greeks() computes for the greeks and has an output table of the greeks.

GenBS() is the Black-scholes Merton way for computing european options

DrawTree() generates a designed tree complete with asset price and option prices. Though it is not as efficient as I would like. I computed for 100 steps and it took 9 secs to generate the tree alone.

DrawTree2() generates a tree in a more efficient manner. I have a choice whether what tree to generate. Either the price tree or the option value tree.

The functions are just a way to make the code flexible and more user-friendly. Though I don't know what to do with them right now at my codes..maybe later it will be handy.

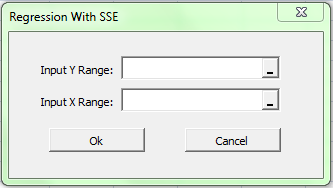

Will do the user part next. and then the output sheets.

New to the code:

- Learned: Declaring variables outside the sub or function

- ActiveCell.Offset(0, 0).Value

- Range(starter).Offset(0, 0).Value

- On properties of the range

- With ... End With

- .Interior.ColorIndex = 34

- .Borders.Weight = xlThin

- .HorizontalAlignment = xlCenter

- .Value = OptionValue(lp, j)

C

ode:

Public OptionValue() As Double

Public Price() As Double

Public bsOV As Double

Public kind As String

Public z As Integer

Public So As Double

Public K As Double

Public q As Double

Public r As Double

Public T As Double

Public n As Integer

Sub Test()

So = 100

K = 95

q = 0

r = 0.08

vol = 0.3

T = 0.5

n = 5

'kind = "a" 'american = a, european = e

z = -1 'for call z= -1, if for put z= -1

starter = "C11"

Range(starter).Offset(0, 0).Value = "European:BS"

Range(starter).Offset(0, 1).Value = GenBS(z, So, K, q, r, vol, T, n)

Call GenEurAm("e", z, So, K, q, r, vol, T, n)

Range(starter).Offset(1, 0).Value = "European:CRR"

Range(starter).Offset(1, 1).Value = OptionValue(0, 0)

Range(starter).Offset(3, 0).Value = "Asset Prices:"

Range(starter).Offset(4, 1).Select

Call DrawTree2(n, Price)

Range(starter).Offset(n + 5, 0) = "European Option Prices:"

Range(starter).Offset(n + 6, 1).Select

Call DrawTree2(n, OptionValue)

Call GenEurAm("a", z, So, K, q, r, vol, T, n)

Range(starter).Offset(1, 3).Value = "American:CRR"

Range(starter).Offset(1, 4).Value = OptionValue(0, 0)

Range(starter).Offset(2 * n + 7, 0) = "American Option Prices:"

Range(starter).Offset(2 * n + 8, 1).Select

Call DrawTree2(n, OptionValue)

Range(starter).Offset(3 * n + 9, 0).Value = "Greeks:"

Range(starter).Offset(3 * n + 10, 1).Select

Call Greeks

End Sub

Private Sub GenEurAm(kind, z, So, K, q, r, vol, T, n)

'computation of the formulas

u = Exp(vol * Sqr(T / n))

d = 1 / u

b = Exp((r - q) * T / n)

p = (b - d) / (u - d)

df = Exp(r * T / n)

'Price tree

ReDim Price(0 To n, 0 To n)

'American and European Option tree

ReDim OptionValue(0 To n, 0 To n)

For j = n To 0 Step -1

For lp = 0 To j

'Price tree

Price(lp, j) = So * u ^ lp * d ^ (j - lp)

whenX = z * (Price(lp, j) - K)

'option tree

'at the end nodes

If j = n Then

OptionValue(lp, j) = Application.WorksheetFunction.Max(whenX, 0)

'at other nodes

Else

whenNotX = (p * OptionValue(lp + 1, j + 1) + (1 - p) * OptionValue(lp, j + 1)) / df

'for american option

If kind = "a" Then

OptionValue(lp, j) = Application.WorksheetFunction.Max(whenX, whenNotX)

'for european option

ElseIf kind = "e" Then

OptionValue(lp, j) = whenNotX

End If

End If

Next lp

Next j

End Sub

Private Sub Greeks()

'after calculating the prices and the option values

'brute force

Dim del(0 To 2) As Double

Dim gam As Double

Dim the As Double

del(0) = (OptionValue(0, 1) - OptionValue(1, 1)) / (Price(0, 1) - Price(1, 1))

del(1) = (OptionValue(0, 2) - OptionValue(1, 2)) / (Price(0, 2) - Price(1, 2))

del(2) = (OptionValue(1, 2) - OptionValue(2, 2)) / (Price(1, 2) - Price(2, 2))

gamma = (del(1) - del(2)) / (Price(0, 1) - Price(1, 1))

theta = (OptionValue(1, 2) - OptionValue(0, 0)) / (2 * T / n)

ActiveCell.Offset(0, 0).Value = "Delta"

ActiveCell.Offset(0, 1).Value = del(0)

ActiveCell.Offset(1, 0).Value = "Gamma"

ActiveCell.Offset(1, 1).Value = gamma

ActiveCell.Offset(2, 0).Value = "Theta"

ActiveCell.Offset(2, 1).Value = theta

End Sub

Private Function GenBS(z, So, K, q, r, vol, T, n)

'Black Scholes Merton

'defining the parts

d1 = Application.WorksheetFunction.Ln(So / K) + (r - q + vol ^ 2 / 2) * T / (vol * Sqr(T))

d2 = Application.WorksheetFunction.Ln(So / K) + (r - q - vol ^ 2 / 2) * T / (vol * Sqr(T))

If z = 1 Then

nd1 = Application.WorksheetFunction.NormSDist(d1)

nd2 = Application.WorksheetFunction.NormSDist(d2)

ElseIf z = -1 Then

nd1 = Application.WorksheetFunction.NormSDist(-d1)

nd2 = Application.WorksheetFunction.NormSDist(-d2)

End If

'getting black scholes

GenBS = z * (So * Exp(-q * T) * nd1 - K * Exp(-r * T) * nd2)

End Function

Private Sub DrawTree(n, starter)

'with design, not efficient

r = 2 * (2 * n + 1)

For j = 0 To n

nrow = r / 2 - 2 * j

For lp = j To 0 Step -1

With Range(starter).Offset(nrow, j)

.Interior.ColorIndex = 42

.Borders.Weight = xlThin

.HorizontalAlignment = xlCenter

.Value = Price(lp, j)

End With

With Range(starter).Offset(nrow + 1, j)

.Interior.ColorIndex = 34

.Borders.Weight = xlThin

.HorizontalAlignment = xlCenter

.Value = OptionValue(lp, j)

End With

nrow = nrow + 4

Next lp

Next j

End Sub

Private Sub DrawTree2(n, ranger)

'after calculating for the prices and the optionvalue

'simple lng

For col = n To 0 Step -1

For nrow = n - col To n

ActiveCell.Offset(nrow, col).Value = ranger(n - nrow, col)

Next nrow

Next col

End Sub

Public Function EuroCall(So, K, q, r, vol, T, n)

Call GenEurAm("e", "1", So, K, q, r, vol, T, n)

EuroCall = OptionValue(0, 0)

End Function

Public Function EuroPut(So, K, q, r, vol, T, n)

Call GenEurAm("e", "-1", So, K, q, r, vol, T, n)

EuroPut = OptionValue(0, 0)

End Function

Public Function AmCall(So, K, q, r, vol, T, n)

Call GenEurAm("a", "1", So, K, q, r, vol, T, n)

AmCall = OptionValue(0, 0)

End Function

Public Function AmPut(So, K, q, r, vol, T, n)

Call GenEurAm("a", "-1", So, K, q, r, vol, T, n)

AmPut = OptionValue(0, 0)

End Function

Public Function BSCall(So, K, q, r, vol, T, n)

BSCall = GenBS("1", So, K, q, r, vol, T, n)

End Function

Public Function BSPut(So, K, q, r, vol, T, n)

BSPut = GenBS("-1", So, K, q, r, vol, T, n)

End Function

Sources:

http://www.cpearson.com/excel/classes.aspx

http://dmcritchie.mvps.org/excel/colors.htm

http://www.global-derivatives.com/index.php/component/content/52?task=view

Black, F. & Scholes, M. "The Pricing of Options & Corporate Liabilities" The Journal of Political Economy (May '73)

Hull, J. "Options, Futures & Other Derivatives" 5th Edition 2002 - Chapter 12

Merton, R. "Theory of Rational Option Pricing" Bell Journal of Economics & Management (June '73)

Mathlab Example, European or American options

- http://www.goddardconsulting.ca/matlab-binomial-crr.html

American Call Option, Greeks, Python, getting data from google finance, etc., Concepts and formulas included

- http://www.quantandfinancial.com/2012/11/cox-ross-rubinstein-option-pricing-model.html

Option Pricing Formulas book, Complete with greeks and American Options p279-288

- http://r2-d2.bu.edu/AT__The_Complete_Guide_to_Option_Pricing_Formulas__2nd_ed_.pdf

Option Calculator

- http://www.volatilitytrading.net/cox_ross_rubenstein_calculator.htm